1. eDDA電子直接扣帳授權介紹

2.eDDA快捷存款的優勢

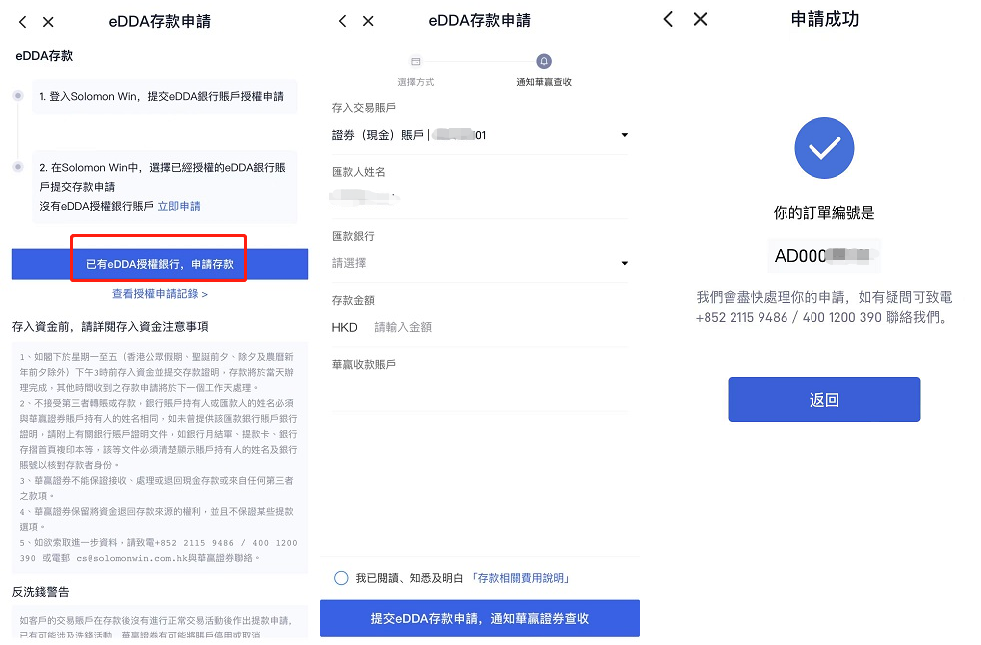

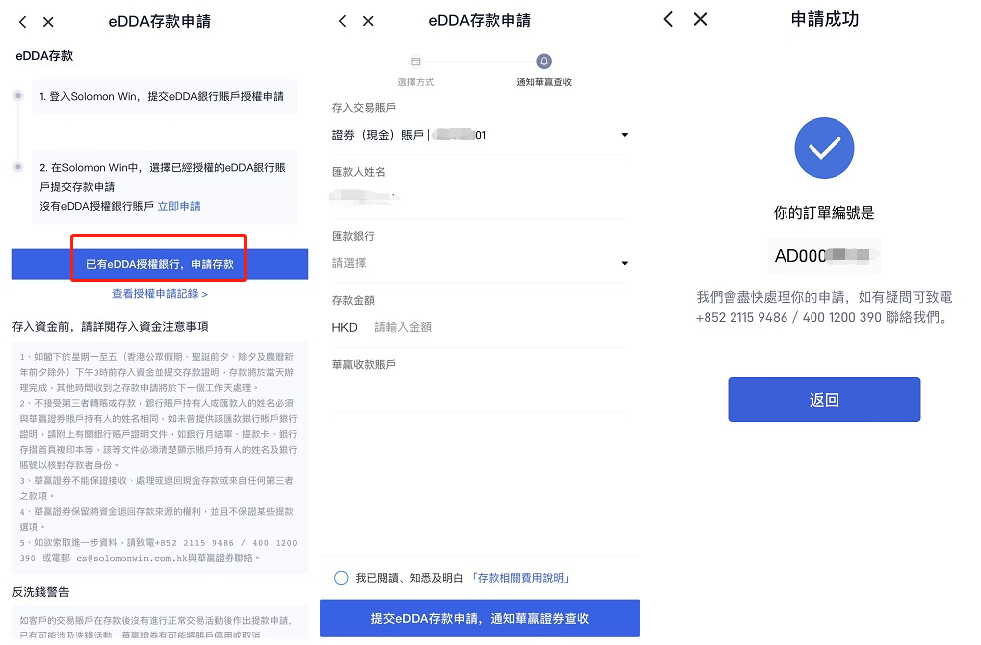

3.授權和存款流程

4. eDDA電子直接扣帳授權-常見問題

A1: 單筆金額不超過港幣500萬:最快5分鐘到賬;

工作日 09:00-18:00且單筆金額超過港幣500萬:約1小時到賬;

其他時間且單筆金額超過港幣500萬將於下一個工作日處理。

A2: 現時eDDA直接付款授權只可轉帳港幣HKD

A3: T銀行登記轉賬至第三方收款人與登記發起eDDA直接付款授權並不相同。 客戶需於「Solomon Win」APP 發起登記eDDA直接付款授權服務,才能使用 eDDA直接存款至證券賬戶。

A4: 不可以,eDDA只適用於本人賬戶,不支援非本人之銀行賬戶。

A5: 可以, 一個證券賬戶可綁定多個不同銀行的港幣賬戶。

A6: 暫時只能支援在選單上的銀行 (*注意*只支援港幣戶口, 並不適用於只有外幣的戶口)

A7: TeDDA直接付款授權失敗,可能由以下原因導致:

1) 客戶的銀行賬戶不適用於eDDA直接付款授權。

請確保:

- Your bank can support eDDA;

- 客戶本人的銀行賬戶於本公司接受的銀行名單內;

- 申請eDDA直接付款授權時輸入的證件號碼須與銀行賬戶持有人之身份證

件號碼一致;

- 必須為港元帳戶;

- 必須為個人銀行賬戶,不接受公司及聯名的銀行賬戶;

- 銀行戶口及證券賬戶狀態都是正常的。

2) 客戶的銀行賬戶資料填寫錯誤。

請確保:

- 銀行編號及名稱選擇正確

- 戶口號碼填寫正確

R請留意:香港銀行賬戶號碼通常為10至12位數字。若您的賬戶號碼少於10位數字, 可表示該銀行分行編號並沒有顯示於賬戶號碼中,請向該銀行查詢分行編號。

A8: 如因銀行賬戶資金不足導致扣款失敗,銀行將收取手續費,具體手續費以客戶銀行收取金額為準。提交存款申請前請確保銀行賬戶有足夠資金。

A9: 客戶可因應自己的使用情況而設定eDDA授權有效時期和存款上限, 向銀行申請修改。於登記時預設申請金額為「最大金額」或「不設上限」,有效時期為「直至另行通知」或「不設定」以確保該授權設定不會因過期而失效,但個別銀行可能對於每天存款次數和金額設有限制,詳情可與相關銀行查詢。

A10: 客戶可於「Solomon Win」APP > 點擊「我的銀行卡」頁面中查看已授權的銀行卡,選擇想取消授權的銀行卡 > 點擊「解除綁定」 > 點擊「確定」即可。

請注意,此處只是刪除客戶於華贏證券的授權申請,客戶如想完全刪除銀行賬戶的綁定記錄,需親自聯絡銀行處理。